Mohawk Group: AI meets Ecommerce

Investment Thesis: Consumers have become increasingly more reliant on e-commerce marketplaces to purchase everything from consumer staples to discretionary goods. As a result, consumers have become more data-driven and purchase products with marketplace dominance and social proof instead of brand value. Mohawk Group (MWK) leverages AI to analyze terabytes of data, identify product opportunities, and bring those products to market. The company’s AI platform automates inventory management, forecasting, marketing, and pricing in real-time allowing for a 3x shorter go-to-market cycle compared to the traditional model. As the e-commerce industry continues to grow, MWK will be in a position to take advantage of new product opportunities much faster and more efficiently than incumbents in the CPG industry.

E-commerce

The e-commerce industry has seen strong tailwinds from the lockdown measures implemented globally as a result of the pandemic. The initial lockdown measures resulted in US e-commerce penetration experiencing 10 years of growth in 3 months during Q1 2020. However, the growth in e-commerce hasn’t been limited to the US as seen by the graphic below.

This growth is largely due to the pandemic and is expected to slow in the following year as brick-and-mortar stores see an increase in demand due to consumers’ pent-up demand for a return to normalcy. However, many consumers will continue purchasing through e-commerce marketplaces. According to Shopify, 48.8% of consumers will continue to shop online once the pandemic is over. Additionally, the majority of consumers prefer to shop online because of direct delivery, cheaper prices, and convenience. These factors will not change post-pandemic and will continue to drive growth in e-commerce in the future.

Based on data from Statista, global retail e-commerce sales totaled $3.53 trillion and are expected to grow to $6.54 trillion by 2022.

Marketplace Dominance vs Brand Value

As retail has continued its shift to e-commerce, traditional retailers are providing e-commerce marketplaces for brands to sell directly to consumers rather than the traditional business model of brands selling to retailers who sell to consumers. This model is called the direct-to-consumer (“DTC”) model. An example of this is Walmart. Walmart’s e-commerce marketplace now allows third-party sellers (“3PS”) to sell their products directly to consumers through their online marketplace. This has lead to a wide variety of consumer products being offered by brands that lack the brand value of traditional brick-and-mortar incumbents.

As a result, consumers have become data-driven and make their purchases based on reviews and ratings. Shopify reported that 70% of Amazon searches do not include a brand name and 90% of Amazon product views result from searches not branded ads. Additionally, Marketplace Pulse reported that 78% of the top 100,000 search terms did not include a brand within the search. The Shopify report also stated that of the 75% of consumers who say they tried different online brands during the pandemic, 60% expect to integrate the new brands and stores into their post-COVID lives.

This shift in consumer purchasing behavior towards products with marketplace dominance as opposed to brand value is a major threat to incumbents in the consumer products goods industry that have failed to adapt or simply cannot adapt to the change in consumer behavior.

It’s important to note marketplace dominance can lead to brand value. A fascinating example of this is Anker. Anker started in 2011 as an Amazon seller selling computer and mobile peripherals. Currently, Anker is valued at over $1 billion and the second-largest US seller on Amazon. Anker is an example of what MWK hopes to achieve with its brands as it continues to expand its product portfolio and optimize its AI platform to automate everything from pricing to logistics.

Fulfillment Network

Shopify states fulfillment as a key competitive advantage in e-commerce as the space continues to become overcrowded. A consumer content study conducted by Adobe in 2019 revealed consumers are becoming increasingly more impatient and demanding. The study focused on the digital experience of consumers and reported that younger users are more likely to stop viewing content if it takes too long to load. Nevertheless, this is transparent in e-commerce as well where 67% of US consumers expect either same-, next-, or two-day delivery.

Increased consumer demand and rising shipping costs have put pressure on e-commerce sellers’ margins. FedEx announced an average 4.9% rate increase for 2021 and UPS has stated it will increase rates as well. As a result, companies will be required to utilize third-party logistics providers (“3PLs”) or build their own fulfillment centers. Expanding the fulfillment network allows for companies to place inventory closer to consumers leading to lower last-mile fulfillment costs and higher margins. MWK has continued to expand its fulfillment network through 3PLs and Amazon fulfillment to enhance its last-mile fulfillment capabilities.

Mohawk Group

MWK was founded in 2014 and is a self-proclaimed technology-enabled consumer products goods (“CPG”) company. Co-Founder and CEO Yaniv Sarig states the company was founded under the premise that if a CPG company were to be created today, it would leverage data and AI to bring to market product offerings whose success would be based on social proof rather than brand value. As retail has moved to online, traditional CPG companies have failed to transition to e-commerce and adopt the DTC model, this is MWK’s market opportunity.

AIMEE

At the center of MWK is its proprietary software technology platform called Artificial Intelligence Mohawk e-Commerce Engine, or AIMEE. AIMEE analyzes data from e-commerce platforms and other publicly available sources to determine which products to bring to market based on market insights such as consumer sentiment, product trends, etc. Additionally, AMIEE integrates with e-commerce platforms through APIs which allow for automated marketing and pricing.

AMIEE’s functionality is composed of four modules:

Market Research: This is where product opportunities are discovered by analyzing data to determine consumer sentiment, product trends, and market insights.

Financial Planning and Analysis: The FP&A module performs cash flow projections for individual projects and compares projections with real-time results.

Automated Marketing Strategy Execution: Manages at intervals of one minute to one hour, price, media buying, product listing health, search engine optimization, and inventory levels. This module automates marketing strategies and continually learns and improves with each iteration.

Last-mile Fulfillment: In an interview CEO Sarig mentions the addition of module for optimizing last-mile fulfillment. This module connects to nine warehouses across the US and helps to company achieve better-optimized shipping rates.

AIMEE still requires some human judgment today but MWK states it is continuing to expand AMIEE’s capabilities and hopes to eventually automate supply chain and logistics operations. Here’s a video giving a brief overview of the platform:

Business Model

"Our mission is to create brands that deliver to our customers superior products than the incumbents by infusing technology throughout the entire value chain. We believe that this makes it possible for us to launch evergreen products with features that customers have indicated are the most important to them and with profitable unit economics. With scale, we gain purchasing power both at the product level and at the overall fulfillment level, which improves our operating results."

Source: MWK 10-K FY19

With the insights provided by AIMEE, MWK is able to bring to market products nearly 3x faster than incumbents under the traditional business model. Here’s the product lifecycle for MWK:

Utilize AMIEE’s market research to find product opportunities in e-commerce marketplaces.

Contact manufacturers in China to manufacturer products under one of MWK’s owned and operated brands with a target commercial launch date within six to eight months.

MWK has executives and employees in China to manage the supply chain, ensure products go through the proper testing and quality assurance before shipment, and to build and maintain relationships with manufacturers.

Once imported from China, MWK utilizes fulfillment by Amazon (“FBA”) and fulfillment by merchant (“FBM”) to achieve two-day delivery through ground shipping across 95% of the U.S. market.

In Q4 2019 expanded its FBM network to provide one-day prime delivery to 90% of the U.S. market. Expanding the FBM network also diversifies MWK’s logistics network and allows the company to be less dependent on Amazon for fulfillment.

Once launched, a product has three phases:

Launch Phase: During this phase, there is heavy investment in sales and marketing and products can see contribution margins (“CM”) as low as -35%.

Sustain Phase: MWK expects products to reach the sustain phase within 3 months of launch and targets an average CM of 15%. The long-term CM target is 18-20% up from the initial target of 10% mentioned in the S-1.

Milk/Liquidate Phase: The liquidate phase refers to products that fail to reach the sustain phase and are liquidated. The milk phase refers to products that become a strong leader in their category in both customer satisfaction and volume sold relative to their competition.

Over the long-run, MWK expects the products in its sustain phase will produce cash flow in excess of investment in new products which is their path to profitability. In the most recent earnings call, the company stated an 80% success rate with regards to products going from the launch phase to the sustain phase.

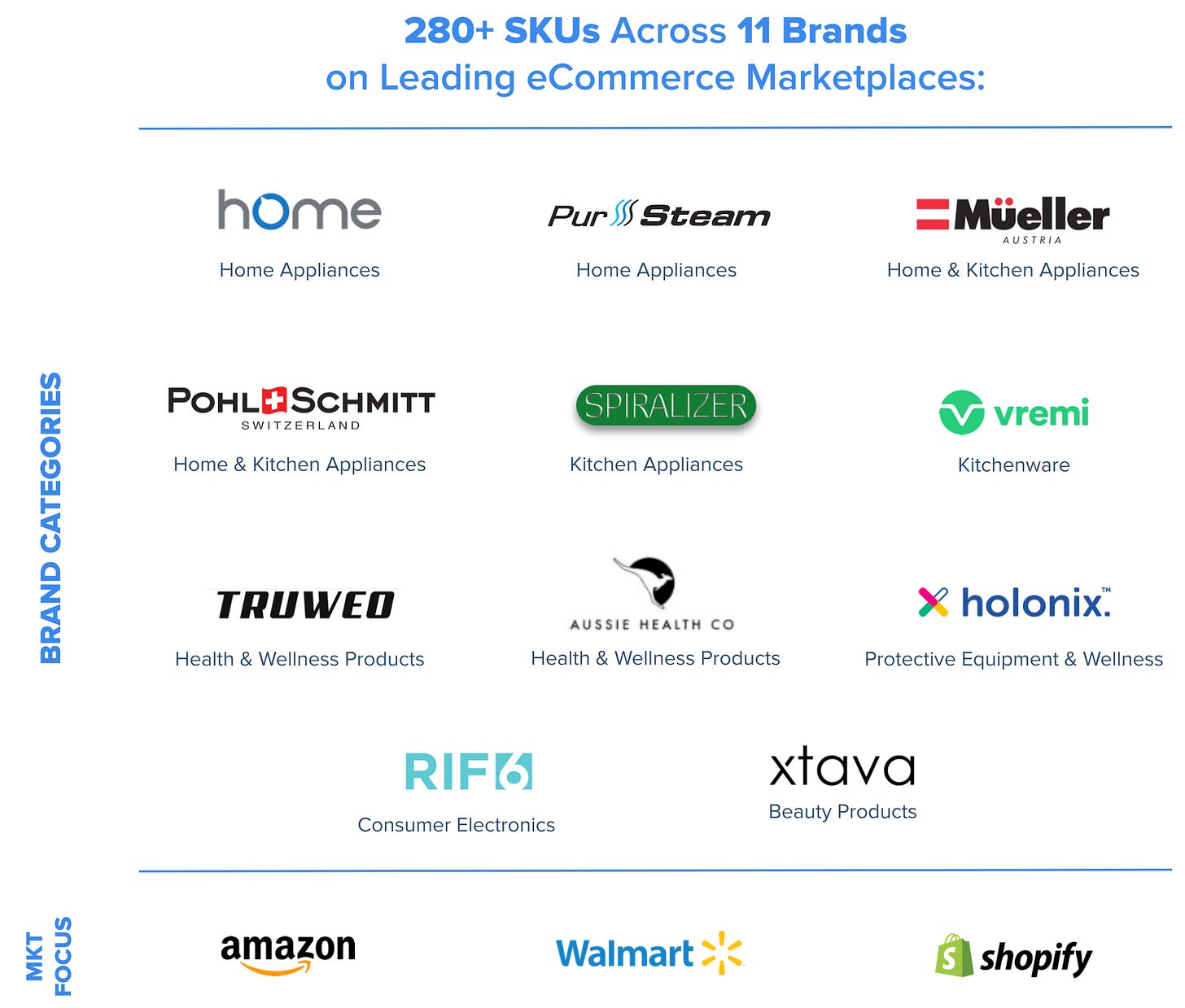

Brands

As of the most recent quarter, MWK has 280+ SKUs across 11 different brands of which 6 were acquired and 5 created organically. MWK sells these products on Amazon, Walmart, and Shopify but plans to expand to other e-commerce platforms as well. These products span across different categories including home & kitchen appliances, health & wellness products, beauty products, and consumer electronics but MWK isn’t limited to these categories.

The following are the top brands in MWK’s portfolio right now:

hOmeLabs: Home & kitchen appliances

Amazon best sellers: mini-fridge (4.6/5 starts w/ 3K+ reviews)

Amazon seller rating of 97% positive w/ 10K+ reviews

Vremi: Home & kitchen appliances

Amazon’s choice: cookware set (4.6/5 stars w/ 2K+ reviews)

Mueller Austria: Home & kitchen appliances

Amazon best sellers: juicer (4.3/5 stars w/ 21K+ reviews), blender (4.6/5 stars w/ 30K+ reviews), chopper (4.6/5 stars w/ 4K+ reviews), electric kettle (4.7/5 stars w/ 26K+ reviews)

Amazon’s choice: slicer (4.5/5 stars w/ 15K+ reviews)

Pur Steam: Steamers

Amazon best sellers: steam mop (4.3/5 stars w/ 23K+ reviews), handheld steamer (4.1/5 stars w/ 15K+ reviews), steam iron (4.6/5 stars w/ 17K+ reviews)

Truweo: Health & wellness

Amazon best sellers: posture corrector (4/5 stars w/ 53K+ reviews)

Amazon’s choice: massage tool (4.4/5 stars w/ 2K+ reviews)

This list includes only products that have Best Seller or Amazon’s Choice badges, however, the majority of these products have very good reviews typically above 4 stars. MWK reported an average of 4.4/5 stars for all MWK products and 110 products in the top 5 search results on Amazon.

Growth Strategy

The typical growth strategy for any company includes expanding internationally, adding new products, selling up-market, etc. These all apply to MWK as well but expanding their product portfolio, expanding across different marketplaces, monetizing AIMEE will be important growth drivers in the future.

Growing Product Portfolio

In an interview, CEO Sarig stated that MWK plans to eventually have a portfolio of thousands of products each with profitable and recurring revenue streams that are managed entirely by AIMEE to build a multi-billion dollar CPG company. To reach that scale, MWK expands its product portfolio through the organic creation of brands and products as well as pursuing an aggressive M&A strategy.

MWK’s M&A strategy is to pursue growth at accretive multiples. Targets include small Amazon sellers that lack the technology and scalability but have products with marketplace dominance and strong cash flows. MWK can acquire these brands and utilize AIMEE to scale them. Deals are typically asset only deals where MWK purchases listing, IP, assets, and manufacturing relationships, and generally, no headcount is added for MWK. Quick onboarding and integration with AIMEE allow for an efficient M&A strategy to drive growth. Recently, MWK managed to integrate Truweo with AIMEE within 48 hours after the deal closing.

As of the most recent earnings call, management states it is planning to bring to market 10 new products a month in 2021 while continuing to pursue its M&A strategy.

Expanding Across Marketplaces

Currently, MWK generates nearly all of its revenue from Amazon’s US marketplace. The company has expanded to Walmart and Shopify, however, those marketplaces have yet to bring in substantial revenue. MWK’s brands hOmeLabs and Vremi have taken advantage of Instagram’s e-commerce marketplace which I expect the company to do for future brands as well as they execute their omnichannel marketing strategy.

International expansion will be crucial as well. MWK has yet to build a presence in China with Tmall, India with Flipkart, South America with MercadoLibre, and Southeast Asia with Shopee to list a few. Expanding to international e-commerce marketplaces will significantly increase the TAM and be a major growth driver.

Monetizing AIMEE

In 2018, MWK began offering AMIEE’s capabilities to 3PS with a SaaS model. The offering includes nearly all of the same capabilities MWK uses internally to manage their portfolio of products and gives 3PS access to MWK’s integrated DTC fulfillment program if the clients’ 3PLs do not allow DTC fulfillment. The long-term goal of this service would be to provide an end-to-end solution for 3PS the integrates AIMEE into the entire supply chain and business operations of sellers.

Currently, this SaaS business accounts for ~1% of total revenue which shows room for substantial growth if MWK can successfully monetize AIMEE. This SaaS model will provide predictable and recurring revenue for the company which can help offset any seasonality experienced with the CPG portion of the company. The graphic below shows AIMEE’s success so far.

The biggest growth driver for MWK is optionality. MWK has tons of optionality with regard to the products they sell, e-commerce marketplaces they operate in, and how they choose to monetize AIMEE (SaaS vs a take rate of GMV).

Moats

CPG Vertical

The following applies to competitors in the CPG market which includes traditional CPG companies as well as 3PS across e-commerce marketplaces. These moats don’t transfer to the SaaS business MWK is pursuing.

Counter-positioning

As mentioned above, traditional retailers are shifting from providing shelves for brands to sell their products to providing e-commerce marketplaces for brands to sell their products directly to consumers. This has resulted in less emphasis on brand value as consumers have become reliant on ratings and reviews to make purchases.

Selling online allows brands to have greater control over marketing, pricing, and inventory management (all the things AIMEE optimizes in real-time). Traditional CPG companies that haven’t adopted this DTC model aren’t able to control these factors in real-time because they sell through physical retail stores. This provides an advantage for MWK because it allows the company to achieve a higher CM. For example, if the data suggests lowering prices will result in a greater number of units sold and will also decrease marketing spend per unit by a greater amount in absolute percentage terms, pricing can be adjusted in real-time resulting in higher CM (this interview provides a better explanation of this around the 24-minute mark). Traditional CPG companies aren’t able to adjust pricing in real-time because they go through retailers where pricing may be pre-determined and cannot be changed in real-time.

Additionally, AIMEE combined with the manufacturing relationships and fulfillment network allow for MWK to identify market opportunities and bring to market products much faster than incumbents.

Furthermore, automation of operations with AIMEE allows MWK to scale tremendously while maintaining relatively low operating expenses. These factors provide a wide-moat against traditional CPG incumbents and 3PS in the CPG space who lack the technological infrastructure to match AIMEE’s capabilities.

Marketplace Dominance

Marketplace dominance is the new brand value in e-commerce. As mentioned earlier, MWK’s products have an average rating of 4.4/5 stars and 110 products in the top five search results on Amazon. These products show marketplace dominance which provides a wide moat against new entrants for MWK as consumers have become more data-driven when shopping online.

Enhancing AMIEE’s capabilities to automate supply chain operations will be crucial for MWK to quickly and efficiently adapt to changing consumer needs and maintain marketplace dominance.

Fulfillment Capabilities

MWK’s FBM capabilities allow them to provide one- and two-day delivery to ~90% of the US while maintaining low shipping costs. Currently, AIMEE integrates with nine warehouses across the US to optimize last-mile fulfillment costs. As AIMEE continues to integrate with more warehouses the fulfillment network becomes more dense and results in lower shipping costs as more consumers are served. This will provide a cost advantage among new entrants who lack similar fulfillment capabilities.

Counter-positioning provides a wide-moat for MWK against incumbents but doesn’t fend off new entrants from adopting a similar business model. MWK will need to focus on strengthening the marketplace dominance of its products and expanding its fulfillment capabilities to deepen its moat against new entrants.

SaaS Vertical

Currently, I don’t see any distinct moats for the AIMEE platform against other companies that provide 3PS tools. However, this report from Avory & Co. outlines a potential bull case for AIMEE that can create a powerful flywheel effect.

Financials

Highlights

Revenue growth for FY19 was 56% ($114MM) vs. 100% ($73MM) for FY18. Based on guidance, revenue growth for FY20 is expected to be 57%-66% ($180MM-$190MM).

Gross margin for FY19 was 39% vs 36% for FY18. Consensus estimates for FY20 are ~45%.

Operating margin for FY19 was -47.5% vs. -40% for FY18. For nine-months ended (“NME”) FY20 operating margin is -8.2% vs. -41% for NME FY19.

CM for FY19 was 2.2% ($2.5MM). CM for NME FY20 is 14.2% ($20.5MM) vs. 4.7% ($4.7MM) for NME FY19. This increase in CM explains the improvement in operating margin for NME FY20.

MWK reports an adjusted EBITDA metric which adds back SCB. Adj. EBITDA as a percentage of revenue for FY19 was -17% (-$19.5MM). The metric for NME FY20 is 1.4% ($2MM) vs. -13% (-$11.9MM) for NME FY19.

CFO margin for FY19 was -22.3% (-$25.2MM) vs. -41.3% (-$30.3MM) for FY18. CFO margin for NME FY20 is 5.3% ($7.6MM) vs. -14.8% (-$13.1MM) for NME FY19.

Revenue

Revenue is composed of three segments: Direct (refers to DTC), Wholesale, and Managed SaaS. As of NME FY20, Direct represents 88%, Wholesale represents 11%, and Managed SaaS represents 0.7% of total revenue. Revenue overall is very concentrated with nearly all revenue coming from Amazon’s US marketplace. This poses a major risk to the company but also means there is room to grow internationally and across different e-commerce marketplaces.

Revenue is fairly concentrated among the products the company sells right now as well. Environmental appliances comprise a substantial portion of total revenue as of the most recent quarter. However, I don’t expect this to be a major risk as the company plans to accelerate the number of products it’s bringing to market in 2021.

Management

MWK is led by a team of experienced executives. Based on LinkedIn profiles, each member has had years of experience related to their respective roles.

Company Culture

“At the end of the day, our model works if we are customer-centric.”

- CEO Yaniv Sarig

An example of this demonstrated with the optimized fulfillment and shipping platform MWK created specifically for oversized items. MWK noticed customers were ordering more commercial appliances online but were unsatisfied with the shipping and packaging that resulted in damaged products during delivery. MWK took this data and targeted the specific problem customers were unsatisfied with and delivered a better product and a better overall customer experience. This proved to be well-received by customers as seen by the growth in revenue from appliances.

Sarig has acknowledged that the company culture is what drives the company’s success stating their culture is “people first”. MWK doesn’t have many Glassdoor reviews but holds a 4-star rating.

Ownership

Insiders own a significant portion of the company’s shares and have bought more shares recently as seen below. It’s good to see management has skin in the game.

Compensation

A significant portion of the top executives’ compensation is through equity grants. Equity grants are based on a time-based vesting feature and are not linked to financial performance.

Competitive Landscape

Traditional CPG companies

MWK differentiates itself from traditional CPG companies by integrating technology throughout its operations. There aren’t any notable pure-play competitors to MWK but two companies that offer similar products to MWK are Newell Brands (NWL) and Helen of Troy (HELE). Both companies sell products under numerous brands similar to MWK but are much larger and lack the operational advantages AIMEE provides.

Newell Brands

NWL is much larger than MWK with $9.2 billion in sales for 2019. NWL has a wide range of brands that span across categories such as food, appliances & cookware, writing, outdoor & recreation, baby, home fragrance, and connected home & security. Some notable brands include Rubbermaid, Crock-Pot, Oster, Coleman, Yankee Candle, and Sharpie.

Helen of Troy

HELE offers products under various brands across housewares, health & home, and beauty categories. HELE is also significantly larger than MWK with $1.7 billion in sales for 2019. Some brands HELE operates under include Hydro Flask, Braun, Honeywell, Vicks, and Drybar.

Comparison

It’s difficult to compare the financial metrics of NWL and HELE to MWK due to the differences in size and capital structure. However, based on gross margins and cash conversion cycle MWK can be seen as operating more efficiently than NWL and HELE. MWK’s gross margins have been improving since FY18 while NWL and HELE have remained nearly flat. MWK’s cash conversion cycle has significantly fallen since FY18 as well. Time will tell if these metrics will continue trending in the right direction as MWK scales but so far its seems that AIMEE allows MWK to operate much for efficiently than NWL and HELE.

As mentioned earlier, MWK has been able to keep its headcount nearly flat while maintaining high revenue growth. As of the most recent fiscal year, MWK had 61 employees while NWL and HELE had 30,000 and 1,650 respectively. Revenue per employee metrics:

MWK has 61 part- and full-time employees and 83 independent contractors based on FY19 numbers. Including independent contractors revenue per employee is ~$792,000. For perspective, Procter & Gamble (~$72.5 billion sales for FY19) reported 97,000 employees which puts revenue per employee at ~$747,000.

FBA Acquirers

FBA acquirers are companies that focus on solely acquiring digital brands that sell products on Amazon and helping them grow, similar to MWK’s M&A strategy. The largest FBA acquirer is Thrasio. Thrasio is a private company and therefore there is limited information on the operations of the company and its M&A strategy. However, Thrasio states it utilizes billions of data points to help maximize sales but there isn’t enough information to determine how the capabilities of their software compare to AIMEE. Thrasio was valued at $1 billion in its latest round of funding.

If Thrasio has developed manufacturing relationships and fulfillment capabilities similar to MWK through its acquisitions they could act as a competitor to MWK in the future. MWK can mitigate the risks from increased competition on Amazon by expanding to other e-commerce marketplaces both in the US and internationally.

SaaS 3PS tools

MWK’s AIMEE platform faces competition from companies providing e-commerce seller tools like Jungle Scout, Helium10, and Teikametrics. These companies provide 3PS with software to manage their e-commerce businesses with tools that span from product research to financial analysis. Based on where AIMEE’s capabilities stand today, I don’t see a major difference between AIMEE and the ones mentioned above.

However, if MWK is able to execute on its plan for AIMEE to act as an end-to-end solution for 3PS it would provide a major competitive advantage for the company over its competitors. MWK already has and is continuing to expand the manufacturing relationships it has in China and its last-mile fulfillment capabilities in the US. These act as high barriers to entry for competitors who wish to offer a similar end-to-end solution for 3PS.

Risks

Geopolitical Risks: MWK is heavily reliant on China for the manufacturing of its products. With the ongoing trade war and increasing tensions with China, MWK faces the risks of higher tariffs or increased regulation.

President-elect Joe Biden has stated he will maintain tariffs against China but develop a new approach that includes coordinated action with allies in the EU and Asia.

Biden stated his primary focus once inaugurated will be on domestic stimulus before prioritizing foreign policy. This means the trade war is far from over and could result in serious consequences for companies without diversified supply chains.

Therefore, it will be important for MWK to look to diversify its manufacturing relationships that include partners outside of China.

Liquidity/Solvency Concerns: MWK has had solvency concerns in the past. In fact, Deloitte issued a going concern warning for MWK as of the most recent fiscal year. During 2019, MWK experienced deepening losses and growing liabilities. However, the company has seen clearer skies since reporting its first EBITDA positive quarter in the most recent quarter. MWK has also reported two consecutive quarters of positive CFO and adjusted EBITDA. Some things to note:

Net Debt (MRQ): -$11.1MM

TTM CFO: -$4.5MM (-3% CFO margin)

TTM FCF (including acquisiton costs): -$18.5MM (-11% FCF margin).

TTM Interest Coverage: -7.8x

Altman Z-score: 2.00 (MRQ) vs -1.98 FY19

Based on these numbers, solvency concerns are still valid. However, if MWK continues performing at the rate it has in 2020 I don’t see the debt obligations being an issue.

MWK’s liquidity/solvency position has improved since 2019, however, if performance deteriorates back towards widening losses I would likely look to exit my position.

For MWK to continue pursuing its M&A strategy it will very likely need to raise capital in 2021. As a result, I expect this to occur through secondary offerings which will result in share dilution.

Revenue Concentration: As mentioned before MWK’s revenue is very concentrated in terms of the marketplaces they operate in (primarily Amazon US marketplace) and the products they sell.

MWK generated 68% of its revenue from humidifiers and PPE, both of which gained an unprecedented increase in demand due to COVID-19. It will be interesting to see if MWK was able to capitalize on this market opportunity due to AIMEE or simply because they rode the tailwinds created by the pandemic.

As more products are brought to market in 2021, I expect the concentration risk of revenue to be minimal.

Valuation

Based on where the company stands today, MWK is a CPG company and should be valued as such. This could change depending on the success of AIMEE as a SaaS.

Based on a fully diluted share count of 23.126MM (based on the closing price on 1/11) implied diluted equity value is $483.3MM and implied enterprise value is $472.2MM (Net Debt of -$11.1MM). MWK is trading at EV/Revenue multiples 2.8x LTM, 1.8x NTM, 1.5x FY21, and 1.3x FY22 based on consensus revenue estimates.

I acknowledge that NWL, HELE, and PG aren’t comparable companies and don’t justify mispricing for MWK. However, just to give some perspective on EV/Revenue multiples for different sizes of CPG companies here they are (data from Koyfin):

NWL: 2.0x LTM, 1.3x NTM, 1.3x FY21, 1.1x FY22

HELE: 3.0x LTM, 2.8x NTM, 2.6x FY21, 2.7x FY22

PG: 5.0x LTM, 4.8x NTM, 4.9x FY21, 4.7x FY22

Given the uncertainty and risks involved with MWK in its current state, it’s no surprise MWK is trading at the lower end of the range. However, if the company continues on its track to profitability while maintaining revenue growth and expanding margins there is substantial room for multiple expansion.

Conclusion

As the pandemic fuels e-commerce growth, consumer purchasing behavior has shifted to making purchases based on ratings and reviews instead of brand value. Incumbents in the CPG industry aren’t in a position to adapt to these changing dynamics of the market. As a result, MWK developed AIMEE to analyze data from e-commerce marketplaces to determine consumer sentiment, product trends, and optimize inventory management and supply chain operations. This in combination with MWK’s network of manufacturers and logistic providers allows the company to bring the product to market nearly 3x faster than incumbents.

MWK has substantial room for growth through an endless pool of products and expanding across different e-commerce marketplaces and regions. This coupled with the plan to monetize AIMEE provides immense optionality.

MWK has made a strong comeback in 2020 after suffering widening losses in 2019. The ability for MWK to continue towards consistent profitability while driving growth and margins will be crucial going forward. However, if MWK manages to do so the long-term growth potential of the company encompasses growth within the retail e-commerce industry as well as the SaaS industry.

*Disclosure: I am long MWK. This is not financial advice, do your due diligence.

If you’ve enjoyed my report and want to keep up with my work, subscribe & share below!